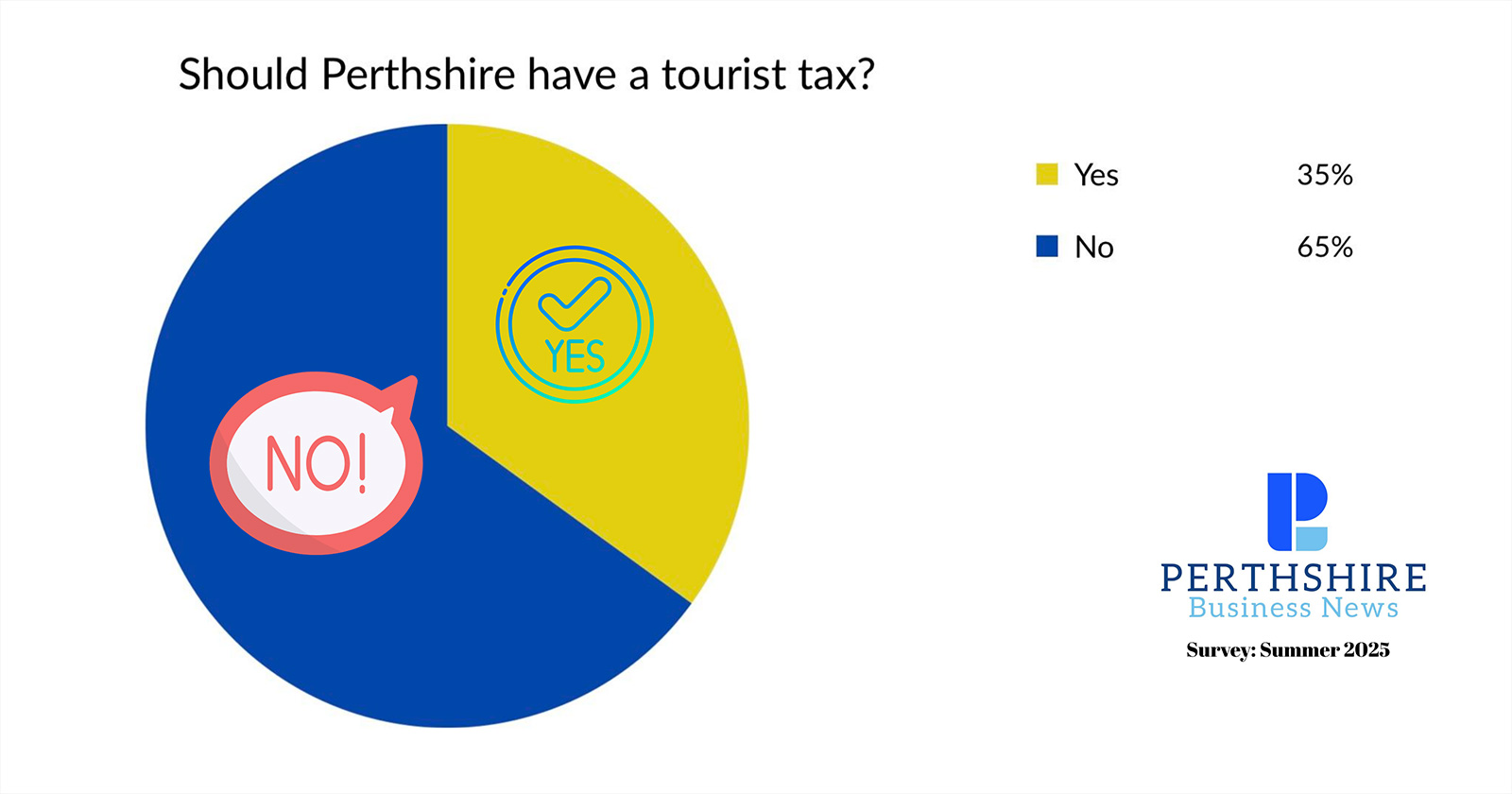

Our Tourist Tax Survey results are in

25 August 2025

PBN readers’ verdict on whether Perthshire should tax its tourists

The vast majority of survey respondents are opposed to the introduction of a tourist tax in Perthshire with accommodation providers almost unanimously against it.

That is the result of a short reader survey conducted by Perthshire Business News on business attitudes towards a proposed visitor levy, which is currently the subject of a public consultation by Perth and Kinross Council.

Tourist taxes have been the subject of much debate and some controversy in Scotland, with Edinburgh set to introduce the first visitor levy (5% on an overnight stay, capped at 5 nights) next summer.

However, proposals by Highland Council have proved divisive and a date is yet to be set for a final decision on whether to follow Edinburgh City Council with a 5% levy.

Perth and Kinross Council is currently consulting on whether to introduce a levy, with options including a 1%, 5% or 7% tariff on an overnight stay.

Divisive

If PBN’s survey can be translated as a gauge of mood (sample size means it cannot claim to be a definitive opinion of Perthshire’s business community), the proposals look set to split opinion in the region.

As a percentage of usable survey responses, 65% were opposed to the introduction of a visitor levy.

When it came to accommodation providers, responsible for the collection of the tax, 93% of respondents say they did not want it, expressing concerns about the impact on their business and more costs being pushed onto customers.

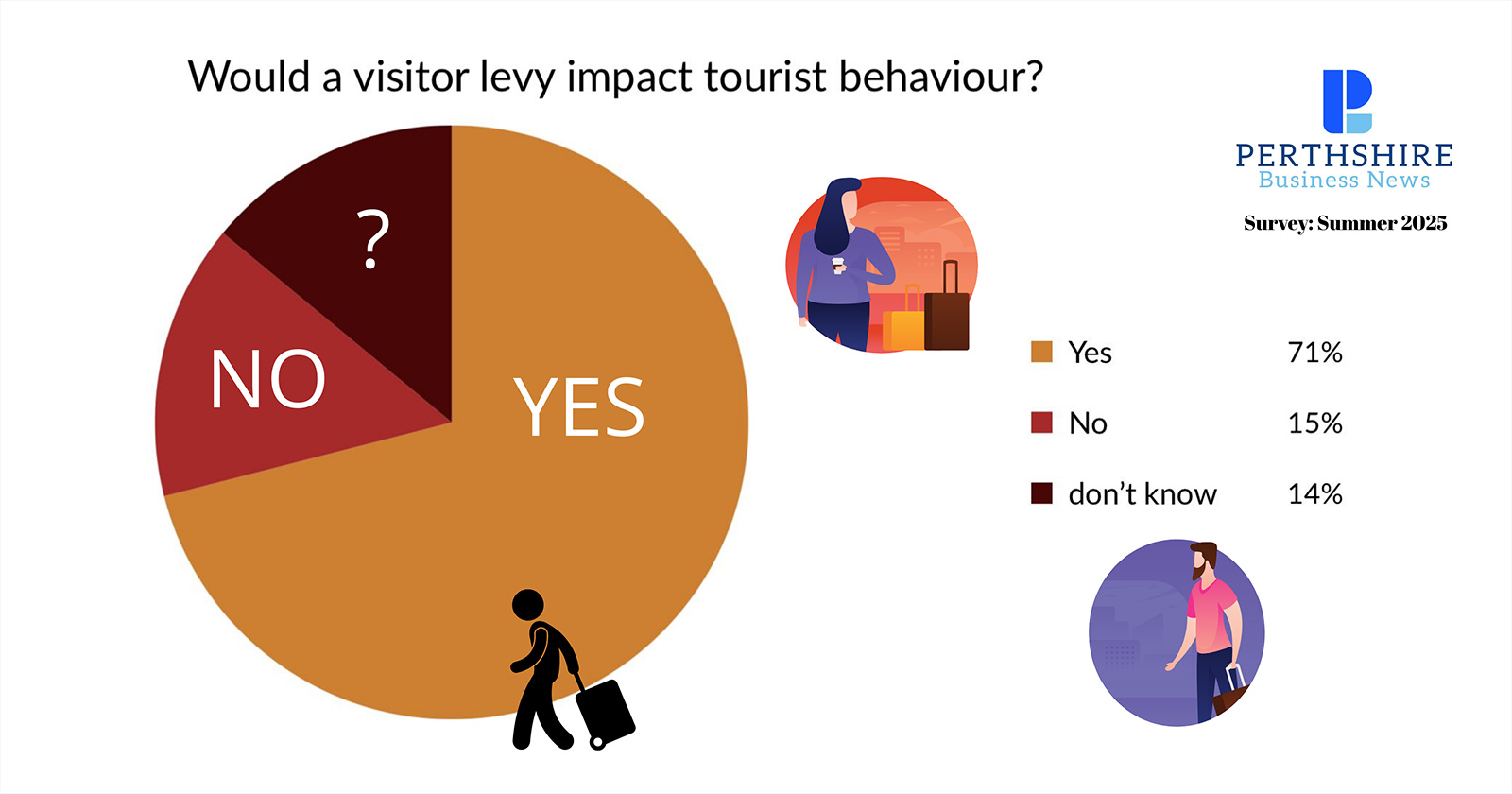

71% of respondents felt the introduction of a charge on an overnight stay would negatively influence visitor behaviour, with the majority of respondents fearing that it would turn some people away from visiting Perthshire.

Only 15% said they felt an additional overnight charge would have no impact on visitor attitudes or behaviour.

Business Concerns

Numbers aside, the survey brought to light concerns which have been aired elsewhere in debates about the introduction of local tourist taxes.

For accommodation providers, the number one concern is that their own taxes could rise as a result, with HMRC treating the extra levy money as additional business income and taxing accordingly.

For some, this could tip them over VAT thresholds or nudge them into higher tax brackets; something few in hospitality can afford at this time.

Several respondents said higher National Insurance rates, wages and business rates had all contributed to real challenges in hospitality and that any additional taxes incurred by administering a visitor levy would leave small businesses with no choice but to raise room rates- something which could price them out of the market.

“People are already saying things are too expensive. They’d rather we were discounting, not raising costs,” said one respondent, with others agreeing that prices for visitors were already high.

All over-nighters impacted

Several others also made the point that the levy would impact all overnight stays, including business travel and even local people going to visit loved ones or relatives in hospital.

However, not everyone was opposed to the idea of introducing a tax.

Those in favour tended to be local people in Perthshire towns rather than accommodation providers themselves.

There was an equal split between a 1% levy and a 5% charge being added but, tellingly, no respondents were in favour of tourists being charged 7% of a room rate per night, despite the fact this could bring in between £11m and £13m to promote tourism and visitor services.

The overwhelming majority of respondents (62%) said that, if a levy was to happen, they would prefer it to be a flat fee for everyone rather than a percentage-based charge.

***

*PBN would like to thank all survey respondents for taking the time to air their views and for supporting Perthshire Business News since its establishment on June 27th.

*Read more about the proposals for Perthshire, here.

*Participate in the Perth and Kinross Council consultation, here.

The official consultation closes on 30th September, 2025.

There are drop-in engagement events regarding the proposed Visitor Levy on 27th August at Loch Leven Community Campus, 4pm to 7pm, and on 5th September at Civic Hall, Perth, 10am to 1pm.